Here are 11 reasons why Xero users should choose Greenback to automate PayPal transactions and ditch the PayPal bank feed in Xero.

If you depend on PayPal to automate your eBay sales you'll need a new solution

eBay Managing payments is the new way to sell and get paid on eBay. eBay is following in the footsteps of other seller marketplaces such as Etsy and Amazon Seller by migrating to their own branded card processing and payment service. Those sellers that were dependent on a PayPal bank feed or data sync app to automate the flow of sales data from eBay to an accounting program will need a new solution.

Greenback simplifies accounting for your eBay sales. Greenback automatically sync your accounting data direct from eBay regardless if your sales were cleared using PayPal or the new eBay Managed Payments service. Greenback auto-fetches your sales, sales related fees, refunds and reimbursements directly from eBay and syncs them to an accounting program.

Your Xero accounting file should do more than prepare you for year end.

First and foremost, we at Greenback believe that your Xero accounting file is more than just a means of managing your financials for the purpose of filing a tax return at the end of the year. When managed properly, your Xero account can be a great tool for analyzing your business and making smart business decisions throughout the year.

Do you need historical PayPal data? Greenback is the only solution to take you back!

The PayPal bank feed in Xero will limit you to 6 months of historical data (at most!). With Greenback, you can acquire data going back years and feel confident in the accuracy of that data.

Be careful – it’s easy to understate or overstate your revenues with the PayPal bank feed in Xero.

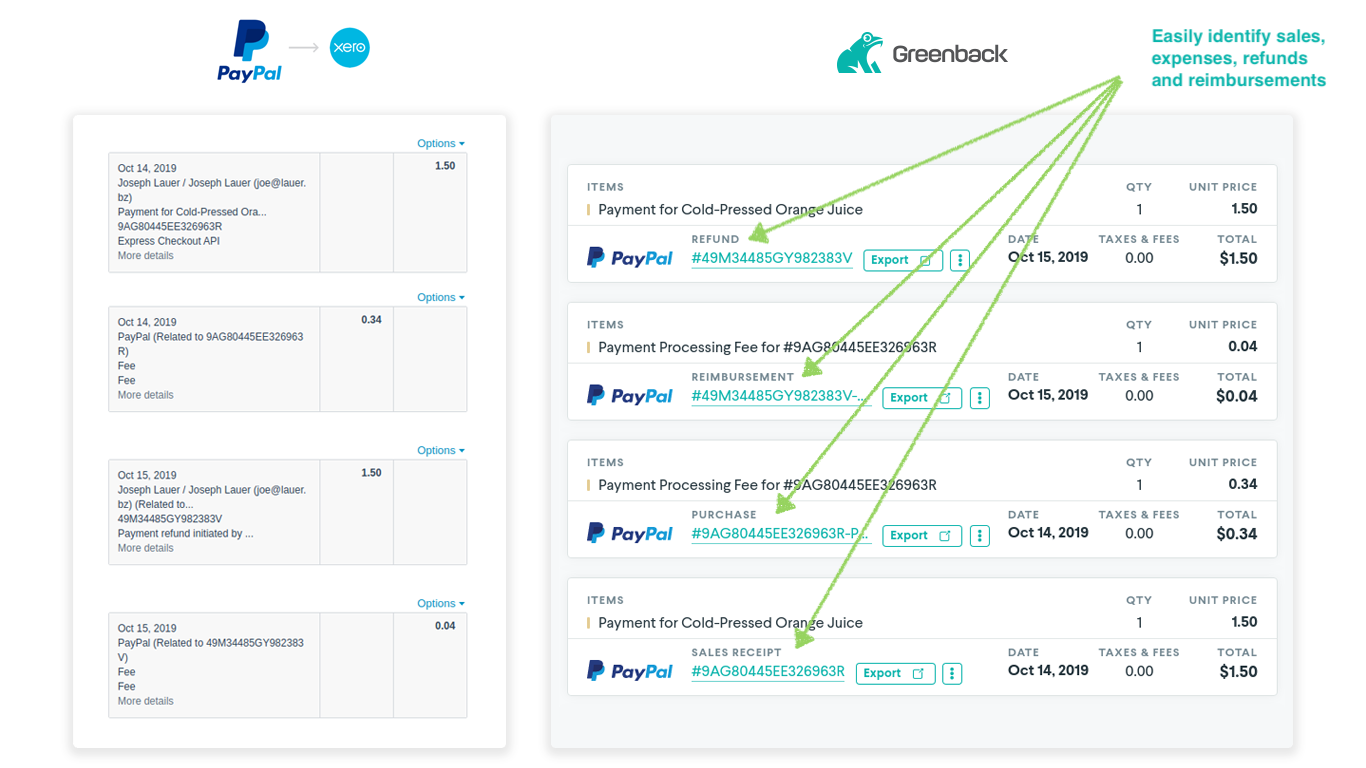

The PayPal bank feed in Xero will is limited to categorizing your transactions as either “Spend Money” or “Receive Money”. If you issue a refund to a customer, it’s highly likely you’ll treat that refund as an expense during reconciliation when instead the transaction should be categorized as a negative sale (refund). When PayPal credits you with the processing fees charged on the original sale, Xero will import that as a Credit (“money received”). The same can be said for items you purchase using your PayPal account and ultimately return. It’s highly likely you will treat the Credit as a sale, when instead the credit should be treated as a negative expense (reimbursement).

Why does this matter? It matters because you can very easily throw off your revenue numbers if you’re treating refunds as sales or reimbursements as expenses.

Greenback is different. Greenback supports 4 types of transactions: sales receipt, refund, purchase, or reimbursement.

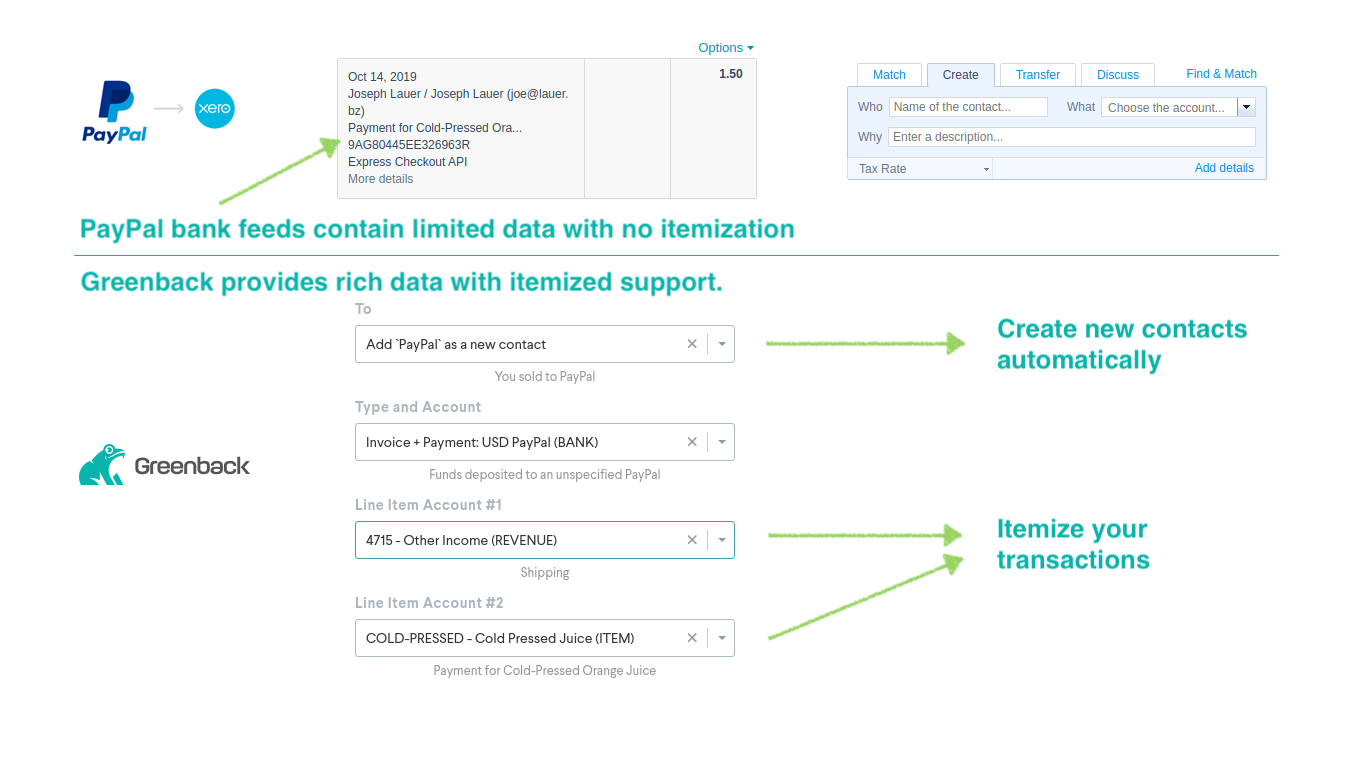

The PayPal bank feed in Xero results in limited data

The PayPal bank feed in Xero is limited to a single line of text (“Statement Lines”). Xero’s bank feed system was not designed to support rich data such as itemized line items, tax rates, billing/shipping address, contact name, email and more. It’s this limited data that can lead to the accounting mistakes mentioned in the previous point.

Greenback however doesn’t rely on the Xero bank feed system to push transactions to your Xero accounting file. Instead Greenback is a pre-accounting system that transforms your PayPal data into a data set that can be easily mapped to individual data fields in Xero. The result is an accounting file you can use to generate reports that help run your business. With Greenback you can push your PayPal transactions to Xero and:

- automatically generate contacts based on your PayPal data

- create transactions with individual line items that can map to products, services or accounts

- map tax rates to properly account for complex tax scenarios.

- build powerful data transforms only possible with the detailed data available in Greenback (For example: apply a 10% VAT rate to sales made in the UK).

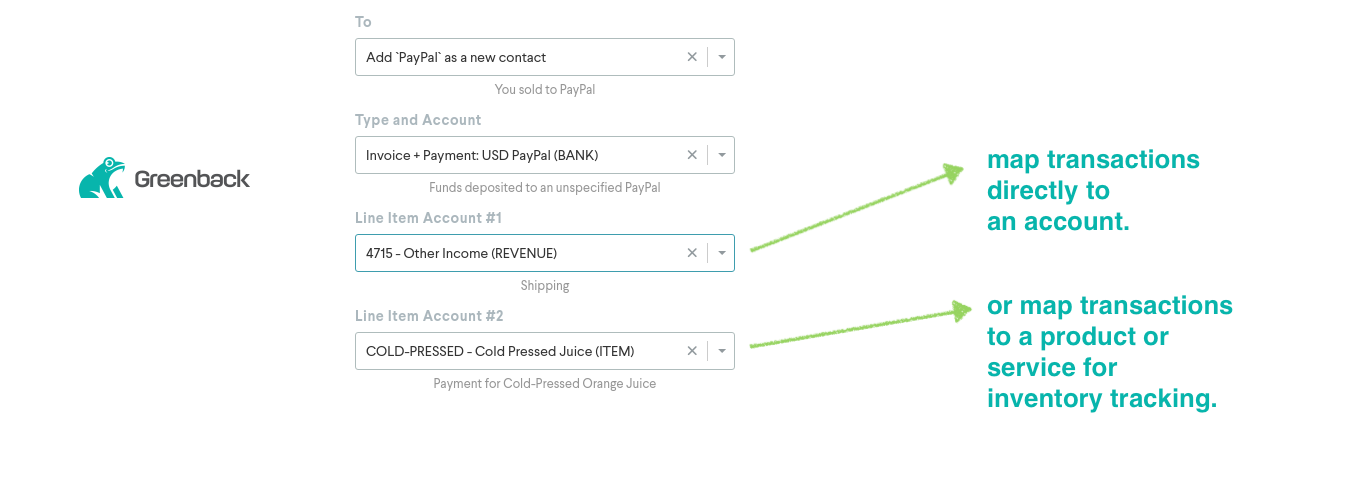

Greenback supports itemized transactions.

The PayPal bank feed in Xero does not support the ability to account for the line items that exist within a transaction. You are limited to assign a transaction to a single account in Xero.

With Greenback, you can easily map each line item within a transaction to an appropriate account in Xero. You can also map transactions to products & services to make use of the inventory tracking capabilities in Xero.

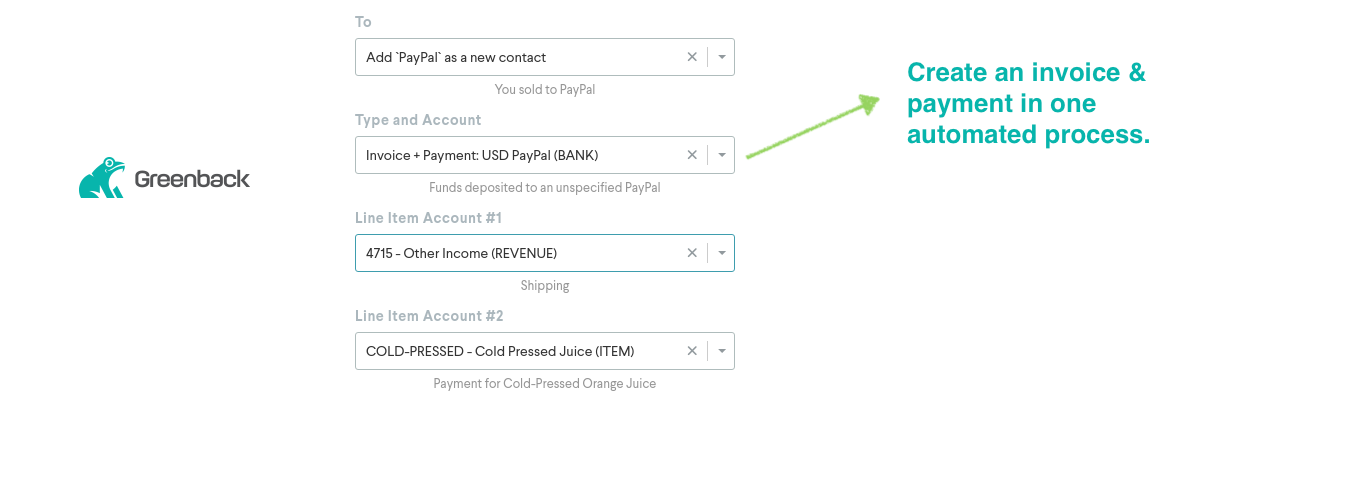

Greenback creates invoices & bills, not just “money spent” or “money received”.

The PayPal bank feed in Xero will treat transactions as either “money spent” or “money received”. Greenback however gives you the option to convert expenses into bills with applied payment, and convert sales into invoices with received payment. This allows your sales to actually show up in the Sales tab in Xero along with your other sales.

Greenback supports multi-currency. The PayPal bank feed in Xero limits you.

Xero limits you to the currency configured on your PayPal account. Greenback will also default to the currency configured on your PayPal account, while also displaying the original currency the sale was made in, along with the exchange rate at the time of sale. With Greenback you can choose to record the transaction in the original currency presented during the sale or you can choose the settlement currency used by PayPal.

The ease of syncing data with Greenback is unmatched.

Xero’s bank statement import requires significant manual work to import large quantities of transactions.

Alternatively, Greenback’s advanced mapping engine and structured data helps you quickly export large quantities of transactions with 100% confidence in a single click.

Audit your sales transactions for completeness of data.

Greenback reports make it easy to visualize your totals across transaction types to ensure you have booked all of your PayPal sales and expenses to Xero.

Full text search

Greenback indexes all of your PayPal data, allowing users to run complex search queries designed to help during the reconciliation process.