The easiest way to reconcile your business sales transactions

Accounting for your global commerce made simple, from fetching your sales transactions to helping you comply with complicated tax requirements across global markets.

-

Connect the payment platforms and marketplace accounts you do business with.

-

Automatically fetch your sales transactions, seperate and itemize your fees, refunds and reimbursements.

-

Manually or bulk export your data to your preferred accounting system.

Businesses spend 120 working days per year on finance related tasks.

Dext Commerce can help cut that in half.

Start a free trial on our growth plan now.

- Start your free trial

- Easy set-up

- Cancel any time

Simple. Connect your accounts and go.

Getting started is simple. Just connect your marketplace and payment platform accounts and we'll auto-fetch your transaction data.

-

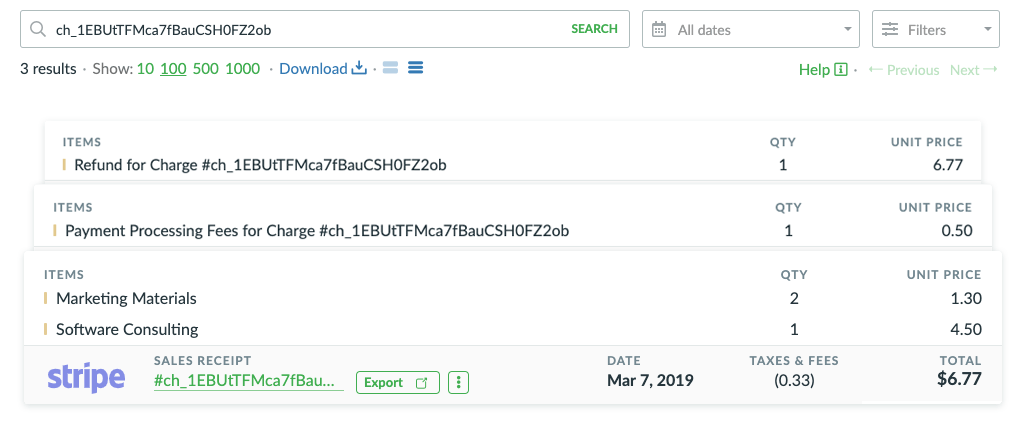

Itemized Sales Transactions

Automatically fetch itemized sales transactions from top marketplaces and payment platforms.

-

Fees & Taxes

Split out expenses, including payment processing fees and taxes so you can accurately account for your sales.

-

Refunds & Reimbursements

Fetch sales refunds and expense reimbursements on the products you sell across different marketplaces and payment platforms.

Direct Integrations

Direct integrations with top merchants and retailers.

Working with your data

Working with your data is easy. View, search, and transform your data, all while maintaining GAAP compliance.

-

Searching

Intuitive searching means you don't need to check boxes or flip switches to view transactions related to specific sales, categories or keywords.

-

Catch Me Up

Need to sync up your historical sales? No problem, Dext Commerce can go back and sync years worth of transaction data.

-

VAT invoices

Fetch the necessary VAT invoices from your platforms.

Rules & Transforms

Global commerce is complex. With Transforms you can automatically modify your transaction data, and use Rules to assign your transactions to the right accounts upon export to your accounting system.

Trigger

New sale from Stripe contains the description Monthly Subscription

Transform

Dext Commerce transforms the transaction to add a SKU number (XR27NU) to the transaction

Rule

Upon export to Xero, we'll match the SKU to a sales account and product within Xero

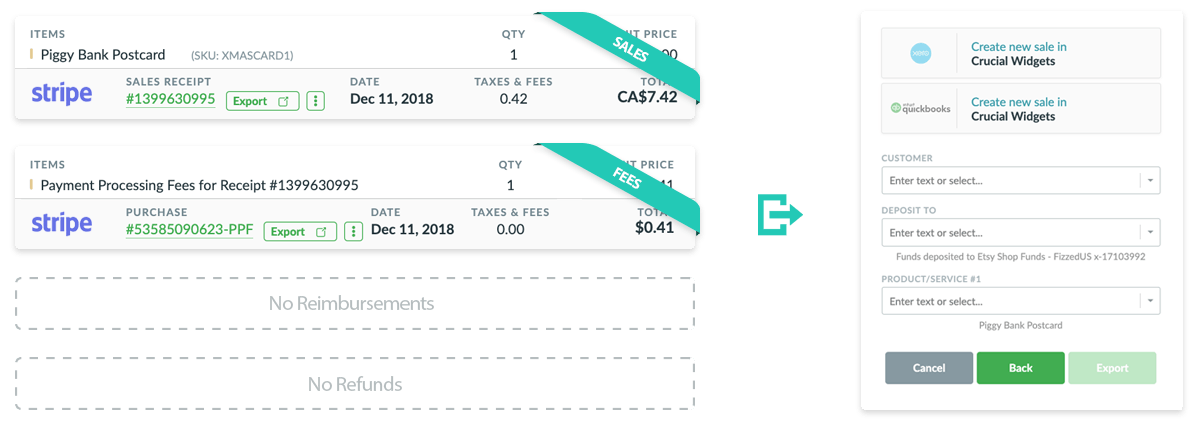

Sync with accounting.

Convert your sales into itemized transactions that can be easily exported to your preferred accounting program.

-

Export Individually

Take greater control of your accounting data. Manually export each itemized purchase on a transaction to your accounting program.

-

Bulk Export

Use memory mappings and export rules to quickly and easily export transactions in bulk.

-

Mapping Rules

Configure your sales transactions to export to accounting using export mapping rules.

Accounting Export Preferences

-

Accounting Programs

Connect QuickBooks & Xero. QuickBooks Desktop, Sage and NetSuite coming soon.

-

All Transaction Types

Separate out your sales, processing fees, refunds and reimbursements.

-

Itemized Export

Choose to assign your transaction to a single sales account, or itemize out each line item to its own sales account.

-

SKU Matching

Automatically assign accounts by SKU or match accounts based on previous exports.

-

Facilitator Taxes

Dext Commerce properly handles marketplace facilitator taxes – tax collected by your marketplace vendor per regulations in some markets.

-

Creating Contacts

Create contacts from the source of the transaction (e.g. Etsy Store, Shopify Store) or the customer contact from the transaction (e.g. John Smith).

-

Transaction Matching

If your transactions already exist in your accounting program, you can enhance the existing transaction or create a new transaction.

-

Bill & Invoice Creation

Accept multiple payments on your products & services? We will create itemized invoices and apply payments against the invoices.

-

Shipping

Allocate shipping costs proportionally across all line items or separate shipping costs as a separate line item.

30,000 strong & growing.

What our clients say.

Great program - handles multiple accounts

This was one of the first programs to come out that would actually pull the receipts from your accounts (physical image if ones available and digital one to be entered), allow you to expense line each item.

4/22/2020

Greenback Rocks!

I'm super excited to be joining Greenback! I upgraded to QBO just to get greenback and the itemized feature! They answered all my questions and helped me with the step by step process to make sure the sync we're processed just how I need them.

5/5/2020

Couldn't live without it!

I sell on Amazon, Etsy and Shopify and there is no way I would have been able to do my bookkeeping without it. In my opinion if you sell on any of these platforms this is a must have app!

03/02/2020

Amazing

Love this app, it saves so much time, it's easy to use and the customer service is brilliant.

01/28/2020

Saved a ton of time!

We were able to get our client added and syncing transactions with QBO effortlessly. This saved us a ton of time to get all the transactions (8000+ per month) posted from Shopify.

01/13/2020

Easy to Use, Incredible Time Saver

Greenback made the implementation and use of this product incredibly simple. I was able to attach receipts to our records in a fraction of the time. One of the most significant advantages of this product is syncing amazon to provide receipts and itemized expense coding in QBO.

01/12/2020

A little difficult, Great over all

I have tried about 10 apps and this one is the best yet. It's difficult to set up, do what you can and contact customer service for the rest. The engineers have seamlessly taken care of any issues I have had. Definitely read as you are setting up things yourself, if you follow the instructions most of the setup is fairly easy.

01/07/2020

Such a time saver!

The ability to pull in line item level detail is amazing. I use same credit card for business and personal Amazon purchases and Greenback makes it very easy to see what is what, especially since the amazon transactions can easily span multiple expense accounts.

12/10/2019

Works great across all marketplaces

We have linked several marketplaces ebay, amazon, etsy, shopify. Very useful and a huge time saver if your entering all your sales manually. wish i had found this app sooner.

10/09/2019

Greenback works really well

This app is great for having a place to store amazon receipts. Amazingly well.

10/03/2019

AWESOME

I absolutely love this. It was a pain before to add my transactions and receipts to QuickBooks. This is so easy! If you own a business especially a construction business, you need this app. Syncs Home Depot and Lowe's. Also I put on Walmart and Amazon.

09/26/2019

Best solution for Etsy

If you value your time then you'll want to automate as much of the accounting process as possible. Greenback streamlines the accounting process for many online sales platforms including the most notorious of them all, Etsy.

09/16/2019

QB expenses look perfect and are automated!

I’m happy I found Greenback. It’s really easy to get started and makes my entries better while I can focus on other things. Honestly, I came here because entering our expenses manually feels boring and tedious to me, I’m extremely glad that Greenback can automate the task for me instead. They can even go back and log expenses prior to integrating their service.

06/27/2019

Saved so much time.

This app saves me so much time importing receipt and purchases from Etsy, Amazon, Stripe. So easy to setup and use.

06/20/2019

Should have done this sooner

The revised Etsy accounting process is a nightmare, but this app simplified reconciling sales, fees and taxes. The support team is a huge asset and quickly responded to my questions helping me to understand the app . It has cut down my workload tremendously. Great!!!

05/30/2019

Join the world's most advanced pre-accounting system.

Start a free trial on our growth plan now.

- Start your free trial

- Easy set-up

- Cancel any time