Overview

If you are starting your own business, now is the time to start streamlining your accounting and reconciling. You'll save time and money before the next quarter or year end. If you connect your standard Amazon account(s) and sync them to your accounting platform, you can automate your transactions. When you are connected, your job costing, pass-through expensing, and tax compliance is simplified. How? Amazon makes it possible to automate your Amazon receipts by integrating with the Greenback app. Greenback automatically imports your itemized receipts for you with your Amazon credentials. Your transactions are then synced to your QuickBooks, or Xero with no manual data entry!

We know how annoying receipts can be even when they are online. Now there’s no need to hunt through your Amazon order history to find them! Rather than guessing what was purchased or returned, you can reconcile with the actual itemized transactions. You can see the spending totals on your dashboard instantly too. You’ll have less work and better insights.

Let’s Start Automating!

Login to your Free or Prime Amazon account at Amazon.com or Amazon.ca or Amazon.com.au to test your credentials if needed.

- Sign up for a Free or Premium Greenback account at Greenback.com

- Connect your Amazon accounts. How to Connect

- Connect your accounting platforms. (Optional)

- That's it!

As soon as you connect your accounts, you'll set in motion the automation of your receipt data. You'll see your transactions immediately. There's no waiting for days or any setup. You do not have to be a business owner or have an Amazon Prime subscription either. Greenback can sync all of your consumer Amazon account(s) to an unlimited number of accounts in QuickBooks, or Xero which is great if you have more than one. By leveraging our amazing transaction data, Greenback supplies you key information, in the right context to help you export with confidence every time and reconcile every cent spent. All of your transaction details are indexed, and easily searchable on our platform and the data (along with the receipt) syncs to your accounting package. For high-volume users, there’s a Bulk Export feature that can save you a lot of time or when you need to catch up on record keeping too.

No matter how you have your QuickBooks, or Xero accounts configured, Greenback’s advanced technology is flexible. During syncs, Greenback automatically matches transactions or creates new ones, auto-fills fields, and automatically attaches the PDFs in your accounting platform for you. Greenback intelligently adapts to your current preferences, custom chart of accounts, and dropdowns. No training wheels are required. You don’t have to worry about duplicate transactions or errors either. Every Amazon transaction goes thru our thoughtfully engineered validation process to ensure you have 100% accurate financial data in your accounting system. See below for tips on starting your business, best accounting practices and how to use Amazon + Greenback to your competitive advantage.

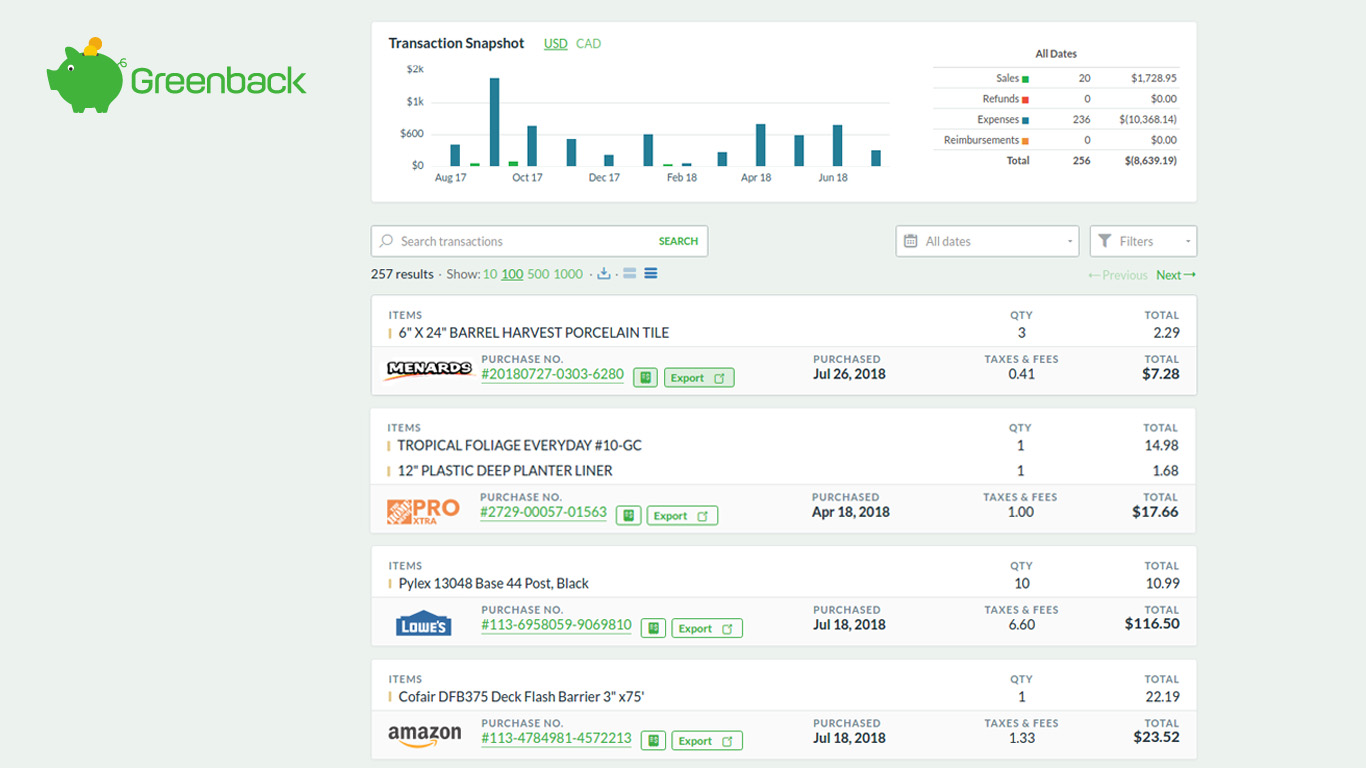

Greenback’s Automated Transaction Feed

To see your Amazon, Apple, eBay, Office Depot, Staples, and NewEgg receipts and more all on one dashboard, try out Greenback.com—powerful technology with time-saving automated features, and 100% accuracy.

Pro-Tip Use the Greenback app to automate your workflow and repetitive accounting tasks. As a predictive tool with intelligent syncs, we provide users with recommendations on what actions to take when syncing to their accounting platform.

How to Print or Save an Amazon Receipt for Your Records

With Amazon: Login to your Amazon.com account and go to “Account & Lists”. Under “Your Account” go to “Your Orders” in the drop down menu. Choose the Year, then choose the Order ie: receipt you are looking for and click on “Invoice” to view it. You can then click on “Print this Page for Your Records” to download/save as a PDF or right click to print it out.

-OR-

With Greenback: Login to your Greenback.com account and click on "Amazon". In the chronological Transaction Feed, click on "Sales Receipt" with enhanced views and live links or the "$" icon of the original. Then right click or click on the printer icon. See Skip Printing below.

Need to Find A Receipt? With our easy, powerful Search, find any detail from any or all of your transactions. Knowing the year or date isn't required! Create a snapshot report of expenses, download/export a CSV file for Google Sheets, Excel or Concur, or download/print PDFs.

Why Not Skip Printing Receipts Altogether? Did you know that you can skip the printing all together and still be tax compliant by integrating with Greenback? Your transactions have an IRS approved digital paper trail. Leave them in your dashboard or sync/export to your online accounting system with no manual data entry. You can do Bulk Exports for even faster syncs. Learn more about Greenback Features

How to Get Amazon Prime for Your Business for Free

If you have a free standard Amazon account, you may want to upgrade to an Amazon Prime subscription. Amazon automatically adds your Prime benefits to your standard Amazon account. But you can also manually add it to your free Amazon Business account when you are ready. So you can take advantage now and bring those benefits with you when you register your business. You'll get free 2-Day Shipping for your business account (only applies to 1 user) as well as your Amazon Prime account (share with 1 user in your consumer account). If you have any employees, they can use their own existing Prime account (or purchase one) for your business shipments as well. There’s also instant 1-2 hour shipping, and versatile front door, porch, or in-car delivery of packages, fresh food, and pantry items in select cities and countries.

Remember you also have free access to unlimited digital business books and magazines, streaming videos, music, and playlists, tv shows, and even cable tv channels. Some limitations or additional costs may apply.

How to Add Prime Shipping to your Business Account:

Login to your Amazon Prime account, click “Your Account”, find “Your Prime Membership” in the right column. Scroll to bottom of page “Share Your Prime Benefits”, "Extend Your Prime Shipping Benefit”. Input your credentials.

Increase Your Cash Flow and Buying Power

If you want to improve your cash flow and don’t have a business credit card yet, prime members are eligible for the Amazon Prime Store Card, with no annual fee upon credit approval. You can earn 5% back on every Amazon.com purchase (excluding promo financing). It’s like having a "free" loan for your business. You get 6 months to pay for purchases if you choose promotional financing on orders of $149 or more. For orders of $599 or more, you get 12 months. You can even use the card wherever they accept Amazon Pay (no 5% back though).

Amazon Reload can be used to help plan ahead and control funds for expenses. You load money directly from your regular checking account to your Amazon account and they add an extra 2%! You just need to set it up by providing your US bank account routing number, debit card, and driver’s license. For best accounting practices, we recommend keeping personal expenses separate from business ones whenever possible. Having consumer credit cards and non-commercial accounts set aside only for your job or business use helps track and separate your expenses if you don’t have commercial cards or business accounts yet. Amazon Reload transactions may not include the last ****4 digits of your card since it is treated as a gift card method of payment. It is recommended that you use your credit or debit cards. See Paying with Gift Cards.

When Paying with Gift Cards & Reward Points

Amazon usually sees credits, gift cards/balances, and rewards points as “discounts” which they simply subtract before showing the transaction Total. But for accounting purposes, you need more detail than that in order to be GAAP (Generally Accepted Accounting Principles) compliant and tax compliant. Typically they are ghosted amounts that go unaccounted for, but Greenback detects and surfaces them. We show you all the itemized details. As an individual or a business, you need to know your true (operating) expenses and see them reflected accurately on your books as well. We recommend that rewards points are reserved for personal purchases only since they are not GAAP compliant and could be viewed as mixing your assets even when you aren’t. A best practice is using different debit or credit cards to separate your personal and business expenses. Many new business owners don’t have a business bank account or commercial credit card yet. We recommend that you keep your business expenses separate in order to maximize your deductions, and prevent fines. Some businesses buy gift cards with cash at a retail kiosk or purchase them online to use as forms of payment for Amazon orders. However, those receipts would not typically be GAAP or tax compliant, or trackable either.

Pro-Tip: When you make a change with your payment methods in your Amazon account, it changes the payment method in your Amazon Pay as well because they are linked. Purchases made with Amazon Pay may not appear in your Amazon account. See Amazon Pay. At Greenback, we do not usually recommend paying with virtual wallets because it is basically like paying with cash.

How to Sort Personal and Business Expenses for Export

Because Greenback indexes every detail of your transactions, your purchases can easily be searched by date, or product. Tracked by the last ***4 digits of your debit or credit cards and sometimes by your gift, or pre-paid cards also. It depends on the type of card and how Amazon treats it. You can then simply choose which receipts to export to your accounting platform. Greenback even gives hints within context to assist you. When you are consistent with your forms of payment, you and your business will have more accurate accounting, and improved tax compliance. If you have an Amazon business account, your receipts can be tracked by PO number, or Job Name or searched by Location (shipping address). If you don’t, they can be tracked by card account number or searched by product, location (shipping address) etc. Note: You can export directly from your dashboard to Google Sheets, Excel, or Concur if you wish. Connecting to an accounting platform is optional.

To DBA or Not to DBA? That is Your Question.

Even if you don’t have an Amazon Business account or a DBA yet, you may want to register your business name to protect it. “A DBA lets you conduct business under a different identity from your own personal name or your formal business entity name. As an added bonus, getting a DBA and Federal Tax ID Number (EIN) allows you to open a businesss bank account.” See Also 4 Different Ways to Register Your Business Name A business bank account is usually required to apply for tax exemption.

Tax Exempt Purchases

Amazon’s Tax Exemption Program (ATEP) is a benefit that works for consumers or businesses. You are not required to have an Amazon Prime or Amazon Business account. The ATEP program makes it possible for customers to apply their tax-exempt status to eligible purchases from Amazon and all of its affiliates. Remember that not all purchases are tax exempt even when you are approved for the ATEP program. Sales tax may still be charged or may be applicable in the future. It depends on your state. You may need to pay the state sales tax for purchases at tax time so please consult with your tax advisor or accountant.

IMPORTANT: Do not mix personal with business if you are making tax exempt purchases. Use consistent payment methods. “In order to qualify for exemption, you may be required by law to pay [for Amazon orders] using your organization’s payment method (e.g., a company credit card) and not a personal payment method (e.g., a personal credit card). To the extent you have a Business Account, you acknowledge that if you, or any business user accounts associated with your Business Account, make tax exempt purchases with a tax exemption certificate associated with the Business Account, that those purchases are made with the tax-exempt organization’s funds. You will comply with such requirement to the extent required by law.” Learn more about Amazon's ATEP program

Taxable & Non-Taxable Purchases

As an Amazon customer, remember that even if you were not charged sales tax at the time of your purchase, you are still required to pay it at tax time. Unless it is an exempt purchase, or it is in a state that never charges sales tax. There are states that now require online stores with click-thru nexus and meets sales thresholds to collect tax from you at the time of purchase, rather than waiting for your payment at tax time. Certain products or services by city, county, or state laws also affect sales tax so please consult your tax advisor or accountant for assistance. Greenback makes sure that taxes are itemized on your transactions and uniquely handled throughout our platform for purchases that are taxable, non-taxable, and tax exempt.

Tax Compliance

It’s imperative that your keep your receipt data for at least 3-7 years (or indefinitely for some receipts) for tax compliance. Some online stores may archive up to only 90 days. According to State Farm, receipts are needed to help you file an insurance claim, make coverage decisions, secure a settlement, or verify property loss for taxes in case of fire, flood, or other casualties. Greenback recommends automating all of your receipts from all of your vendors/shops/marketplaces so that you can be worry-free.

Receipts with an IQ + Cloud Accounting

5 Reasons Why You Need Automated Receipts