"clearing accounts"

Clearing Accounts and Xero

A guide on the importance of clearing accounts in e-commerce accounting, and how to configure Xero to use them.

Clearing Accounts and QuickBooks

E-Commerce Sellers - Create Clearing Accounts

A detailed guide on creating and managing clearing accounts for e-commerce companies.

Best accounting practices for eBay Managed Payments + Xero

Transitioning to eBay's Managed Payments? Learn how to sync your eBay Managing Payments data with Xero.

Best Accounting Practices for Squarespace + Xero

Greenback is the defacto solution for automating your Squarespace accounting. The following article will help you get started with automated accounting of Squarespace data to Xero.

Best accounting practices for eBay Managed Payments + QuickBooks

Transitioning to eBay's Managed Payments? Learn how to sync your eBay Managing Payments data with QuickBooks Online.

Sell with Multiple Payment Providers

How to guide for managing transactions across multiple payment providers.

Reconciliation with Dext Commerce

Best Accounting Practices Squarespace + QuickBooks Online

Greenback is the defacto solution for automating your Squarespace accounting. The following article will help you get started with automated accounting of Squarespace data to QBO.

How to configure QuickBooks Online for Gift Cards

Do you sell gift cards? Learn how to easily track gift card sales and redemptions in QuickBooks

Get Started with Sales

New to Greenback? Start here for a quick walk through on how to use Greenback to automate your e-commerce sales

Automate Your eBay Sales with Managed Payments

eBay Managing payments is the new way to sell and get paid on eBay.

How to Configure Xero for Gift Cards

Do you sell gift cards? Learn how to easily track gift card sales and redemptions in Xero

Migrate your Personal Workspace to a Team

How to migrate your connected accounts from your personal workspace to a team.

Best Accounting Practices for Etsy + QuickBooks

There are just a few concepts to master to maintain your Etsy shop accounting like a pro with QuickBooks. We've spent years perfecting our Etsy integration to make accounting for your shop as easy and accurate as possible. The following steps and how-to videos will help you get setup with Etsy, Greenback, and QuickBooks (optional).

Best Accounting Practices for Amazon Seller + QuickBooks

Find out how much it is costing you to sell on Amazon. There are just a few concepts to master to maintain your Amazon Seller accounting like a pro with QuickBooks. To make it as easy and accurate as possible, we've spent years perfecting our Amazon Marketplace integration for you. The following best practices will help you get setup with Amazon Seller Central, Greenback, and QuickBooks.

Lesson 2 Connecting Your Accounting Program

Migrate Connected Accounts to a Team

Learn how to migrate accounts from one team to another team.

Greenback Features and Tips

Learn about Greenback features and how they streamline your accounting.

Best Accounting Practices for Amazon Seller + Xero

Find out how much it is costing you to sell on Amazon. There are just a few concepts to master to maintain your Amazon Seller accounting like a pro with Xero. To make it as easy and accurate as possible, we've spent years perfecting our Amazon Marketplace integration for you. The following best practices will help you get setup with Amazon Seller Central, Greenback, and Xero.

E-Commerce Sellers - Prepare Your Accounting File

Global e-commerce is complex. This article will provide an overview of the 3 key tasks necessary to best configure your accounting file for e-commerce transactions.

Technical Guide: Etsy

Connect, understand, and optimize your Etsy integration with Commerce.

Best Accounting Practices for Shopify + QuickBooks

There are just a few concepts to master to maintain your Shopify accounting like a pro with QuickBooks. Our Shopify integration makes it as easy and accurate as possible. The following steps and how-to videos will help you get setup with Shopify, Greenback, and QuickBooks.

Introduction to Teams

A quick guide to learn how to collaborate with colleagues using teams.

Best Accounting Practices for Stripe + Xero

There are just a few concepts to master to maintain your Stripe accounting like a pro with Xero. We've spent years perfecting our Stripe integration to make accounting for your shop as easy and accurate as possible. The following steps and how-to videos will help you get setup with Stripe, Greenback, and Xero (optional).

Manage Your Connected Accounts

How to rename and manage connected accounts on Greenback.

Automate Your Amazon Business Receipts

Automate your Amazon Business expense receipts! Greenback will show you how to streamline your accounting and reconciling like a pro. The following steps will help you get setup with Amazon Business, Greenback, and your accounting platform.

Xero Help Guide

It is easy to export transactions from Greenback to Xero. In this tutorial, we will see how to export an Expense (purchase/bill) or a Sale (invoice) and post it to Xero.

Introduction to Automatic Exports

Automatic Exports are yet another Greenback feature designed to increase automation for accountants and bookkeepers.

Automate Your Amazon Receipts

Automate your Amazon receipts! Greenback will show you how to streamline your accounting and reconciling like a pro. The following steps will help you get setup with Amazon, Greenback, and your accounting platform.

Best Accounting Practices for Stripe + QuickBooks

There are just a few concepts to master to maintain your Stripe shop accounting like a pro with QuickBooks. Our Stripe integration makes accounting for your shop as easy and accurate as possible. The following steps and how-to videos will help you get setup with Stripe, Greenback, and QuickBooks.

Best Accounting Practices for Shopify + Xero

There are just a few concepts to master to maintain your Shopify accounting like a pro with QuickBooks. Our Shopify integration makes it as easy and accurate as possible. The following steps and how-to videos will help you get setup with Shopify, Greenback, and Xero.

Connect Accounts

Learn how to connect your accounts from a growing list of retailers, marketplaces, e-commerce platforms, point of sale systems and payment providers.

Lesson 3 Connecting Your Accounts

Automate Home Depot Pro Xtra Receipts

Pros need accurate daily expenses by Job Name or PO number, easy to find receipts, tax compliance, and no manual data entry.

Best Accounting Practices for Etsy + Xero

There are just a few concepts to master to maintain your Etsy shop accounting like a pro with Xero. We've spent years perfecting our Etsy integration to make accounting for your shop as easy and accurate as possible. The following steps and how-to videos will help you get setup with Etsy, Greenback, and Xero.

Get Started with Expenses

New to Greenback? Start here for a quick walk through on how to use Greenback to automate your expense transactions

Handling deferred revenue

For those companies who operate on an accrual basis, accounting for sales made today for future services can be challenging. This is especially true for software companies that sell annual subscription plans. There are a few ways you can accomplish this on Greenback today.

Disconnect Accounts on Greenback

How to disable automatic data sync, disconnect an account or completely delete an account on Greenback.

When exporting expense transactions, how are the account drop-down menus populated?

read more

Introduction to export account mappings

Export mappings are a way for Greenback to associate your transactions to the appropriate accounts in your accounting system.

When exporting sales transactions, how are the account drop-down menus populated?

read more

Accounting for Sales Discounts

Greenback provides you with 3 different options for accounting for sales discounts.

Automate Your Lowe's In-Store and Online Receipts

Tired of manually scanning receipts or snapping photos for your construction accounting, tax compliance, or job costing? Whether you are a contractor, a DIY weekend warrior, or accountant, you can automate your Lowe's receipts. Greenback frees up your time for more important things like building stuff.

Automate Your Online and In-Store Walmart Receipts

Automate your in-store and online Walmart receipts! Greenback will show you how to streamline your accounting and reconciling like a pro. The following steps will help you get setup with Walmart, Greenback, and your accounting platform.

Automate Home Depot Branded Credit Card Receipts

Automate your Home Depot® branded credit card receipts! We’ll show you how to sync your Home Depot credit card receipts so that Greenback can automatically fetch them and export to QuickBooks or Xero.

Teams Replaces Collaboration

Greenback Teams will replace the current collaboration feature.

Manage or Remove Accounting Programs

How to view, manage or remove a connected accounting file on Greenback.

Sync Accounts

Info regarding the frequency of data syncs between the upstream provider and Greenback. Instructions on how to manually sync data on-demand.

The anatomy of an expense export

A quick guide to how Greenback associates your expense transactions to an accounting file

Understanding taxes for e-commerce sellers

The go-to guide for sellers that need guidance on how to account for sales tax, value added tax (VAT) and marketplace facilitator taxes.

Create & Manage Teams

Learn how to create new teams and manage existing teams.

How often will data sync to Greenback?

read more

Retirement of the free plan

Starting September 6, 2021 there are a number of changes being implemented to Greenback Free accounts

Technical Guide: Xero

Connect, understand, and optimize your Xero integration with Greenback.

QuickBooks Help Guide

It is easy to export transactions from Greenback to QuickBooks Online. In this tutorial, we'll see how to export a Sale (invoice) and an Expense (purchase/bill) and post them QuickBooks Online.

The anatomy of a sales export

A quick guide to how Greenback associates your sales transactions to an accounting file

Why can’t I add a Collaborator?

read more

Guide to Marketplace facilitator taxes

Marketplace Facilitator shifts the sales tax collection and remittance obligations from you to the marketplace.

Value Added Tax for e-commerce sellers

Detailed guide for e-commerce sellers on how to account for VAT

Accrual vs. Cash Based Accounting on Greenback

How does Greenback address transactions for cash vs. accrual based organizations?

Export and Publish

step by step guide to export your sales to an accounting program

Lesson 4 Working with Your Data

Lesson 5 Exporting and Reconciliation

Technical Guide: BigCommerce

Connect, understand, and optimize your BigCommerce integration with Greenback.

Search Transactions

Filter your transactions with a flexible and powerful search engine.

Transform Your Accounting Data

Global commerce is complex. With Transforms you can automatically modify your data upon placement in Greenback, and use rules to assign your transactions to the right accounts upon export to your accounting system.

Xero PayPal Bank Feed vs. Greenback

Here are 10 reasons why Xero users should choose Greenback to automate PayPal transactions and ditch the PayPal bank feed in Xero.

Connect Your Accounting Program

If you plan to export your sales or expenses to an accounting file such as QuickBooks or Xero, you will need to first connect the file within Greenback.

Configure Your Accounting Export Preferences

From Customer/Contact records to SKU matching, your export preferences control how data is exported from Greenback to your accounting file.

Reports

The snapshot report lookd at all transactions within the current context and provide a sum of sales, refunds, expenses and reimbursement.

How does Greenback map sales taxes?

read more

Does Greenback support Amazon Fulfillment by Merchant (FBM) and Amazon Seller Fulfilled Prime (SFP)?

read more

Does Greenback support Amazon Handmade?

read more

Sales Tax for e-commerce sellers

Detailed guide for e-commerce sellers on how to account for sales tax across jurisdictions

How Greenback is Streamlining the Digital Paper Trail With Mailbox Connect

APIs to fetch emailed receipts from your mailboxes automatically, or alternatively submit RFC822 emails directly to the API

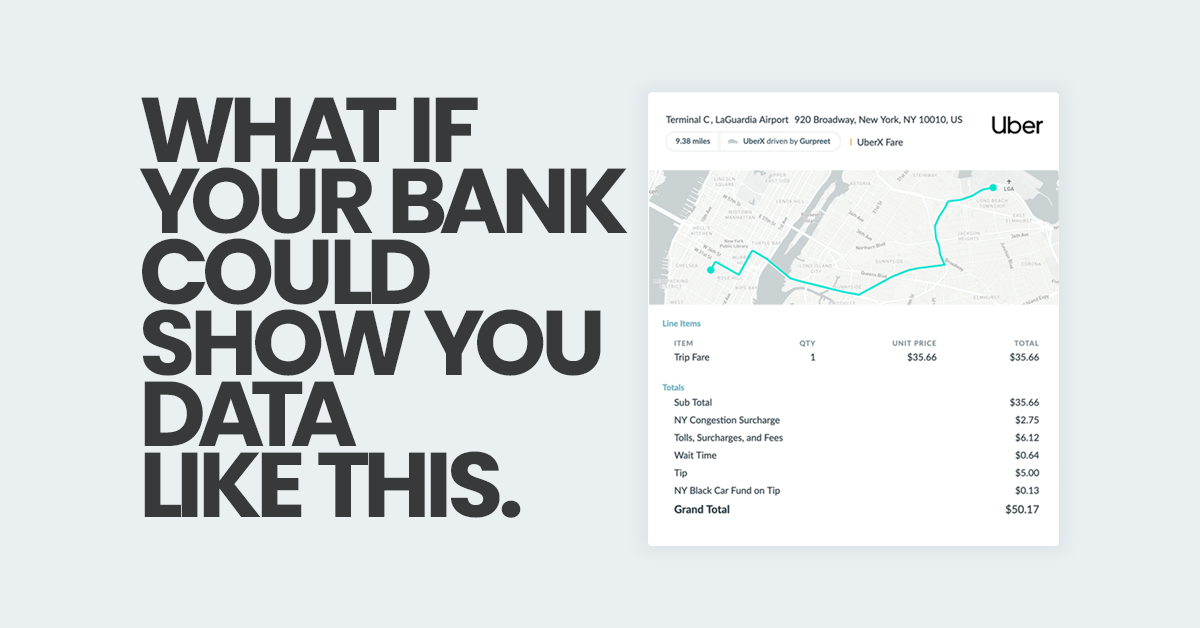

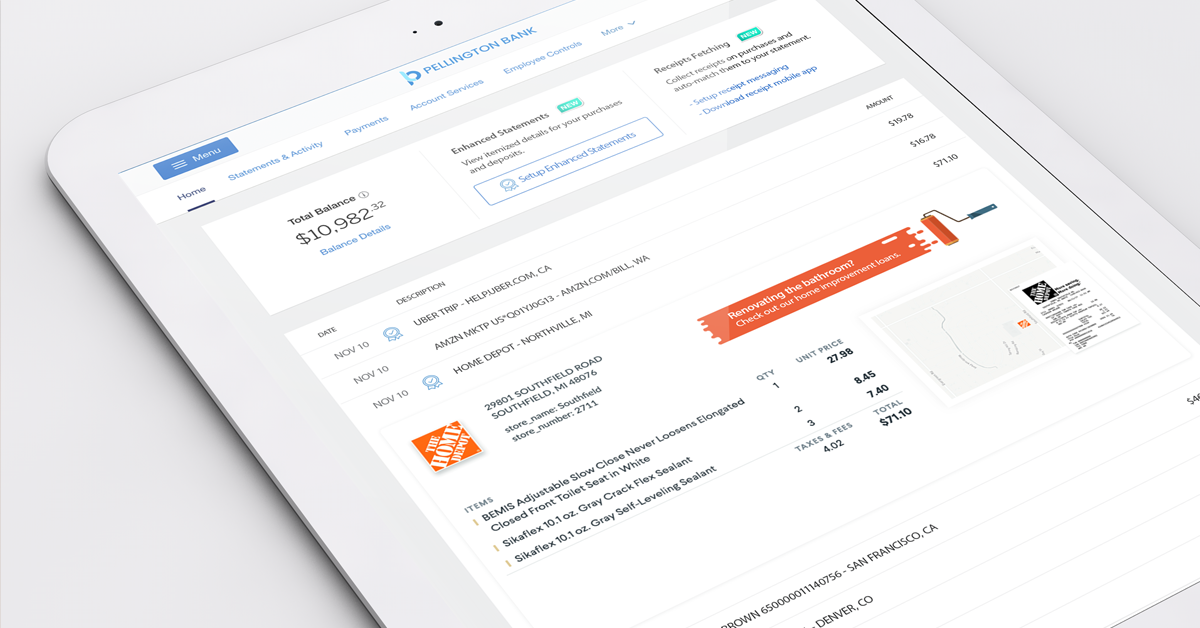

What do businesses really want from their banks?

Business customers are crying out for more frequent and more transparent transactional financial data.

What High definition Data Means for Financial Services

Today there is more and richer financial data available than ever before, but the challenge has become how to properly secure it, and use it to enhance the customer experience, inspire customer loyalty and as a result increase market share.

Mark Transactions as Reconciled in Xero

Here is how to mark transactions exported by Greenback as reconciled in Xero.

read more

Greenback Announces Decimal as First “Greenback for Pros” Master Partner

Greenback Announces Decimal as First “Greenback for Pros” Master Partner - bringing together advisory firms and their customers on Greenback’s accounting automation platform.

Lesson 1 Teams and Inviting Clients

Updating Your Payment Information

Conveniently update your preferred billing card in app through the settings menu.

Technical Guide: Faire

Connect, understand, and optimize your Faire integration with Greenback.

Technical Guide: Stripe

Connect, understand, and optimize your Stripe integration with Greenback.

How does Greenback handle transactions across multiple currencies?

Understand how Greenback helps you manage different currencies resulting from international sales.

read more

Join the world's most advanced pre-accounting system.

Start a free trial on our growth plan now.

- Start your free trial

- Easy set-up

- Cancel any time